Registering a Private Limited Company

Registering a Private Limited Company (LTD) in Kenya is an important step for entrepreneurs and foreigners looking to establish a formal business entity. Learn about the requirements, process, and benefits of setting up your private limited company with this comprehensive guide.

1. Why Register a Private Limited Company (LTD) in Kenya?

The most common form of business establishment in Kenya is the Private Limited Company. Private Limited Companies are popular due to their ease of registration and the absence of minimum or maximum share capital requirements.

2. Benefits and Limitations of a Private Limited Company (LTD)

This type of company issues shares to its members, who have limited liability based on their shareholdings. It must have at least one director, director shareholder or shareholder .

A company is considered a private limited company if:

- It restricts a member's right to transfer shares.

- Limits the number of members to 50.

- Prohibits invitations to the public to subscribe for shares or debentures of the company.

- Requires the consent of all members to add a new member.

3. Preparation and Submission of Required Documents for Registration

- Name Reservation : A search is conducted to determine if the proposed name is available for registration. The name must end with the term "Limited" or the abbreviation "LTD". However, the applicant can apply to omit the word "limited".

- Directors, Shareholders and Beneficial Owners Identification Documents : Provide copies of national identification cards for Kenyan citizens and passports or Alien Cards for foreigners who are directors, shareholders, or beneficial owners of the company.

- Prepare company documents (memorandum and articles of association) : A company may adopt the model articles prescribed by the Companies Act, which outline the company’s structure and governance. Click here to view the model articles for private companies limited by shares. Alternatively, it may choose to create its own articles and define specific objects within them if desired.

- Share capital : While there is no legal requirement for a maximum or minimum share capital, the Registrar of Companies and the Collector of Stamp Duty recommend incorporating a private limited company with a minimum nominal share capital of KES 100, 000. Each share is divided into 1, 000 shares, each valued at KES 100.

- Company Secretary: It is mandatory for all public companies, as well as private companies with a minimum paid-up share capital of KES 5 million, to appoint a company secretary. The appointed company secretary must be qualified and registered with the Kenya Institute of Certified Public Secretaries.

4. Steps to Register a Private Limited Company in Kenya

- Register online with the e-Citizen portal : The Business Registration Services (BRS) simplifies registration by combining name reservation and company registration into a single process. Complete the company registration on the official eCitizen portal.

- Conduct a name search and reservation : To name your company, propose 3 to 5 names in order of preference and priority. Confirm the availability of your preferred name, then reserve it for 30 days. During this period, you can complete online registration form and submit required documents to officially register your company.

- One-Step Form Registration Filling: During registration, fill in the company details step by step, including directors, shareholders, beneficial owners, registered office address, nature of business, company secretary (if applicable), and business commencement date.

- Submit registration documents online to the Companies Registry : Submit all documents via the eCitizen portal. Ensure all documents, including CR 1, CR 2, CR 8, and Statement of Nominal Capital, are signed when submitting to the registrar.

5. The Registration Costs for a Private Limited Company in Kenya

The registration and incorporation fee of KES 10,650 is paid upfront upon completing online registration. These payment registration comprises :

- Registration Fees KES 10,000

- CR12 Search Fee KES 600

- Convenience Fee - KES 50

Payment methods accepted include mobile money, credit/debit cards, and online banking from local banks.

6. The Processing Timeline for Registering a Private Limited Company in Kenya

The registration process for a private limited company in Kenya typically takes approximately 3-5 working days. However, this timeline can vary depending on the specific circumstances and requirements of each case.

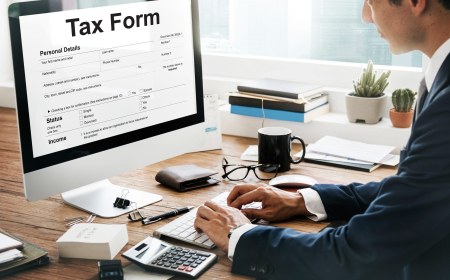

7. Tax Obligations for a Private Limited Company in Kenya

In Kenya, a private limited company has several tax obligations to fulfill. Here is a summary of the key tax responsibilities:

- Corporation Tax (Income Tax) : Resident companies are taxed at a rate of 30% on their profits, while non-resident companies are taxed at 37.5%.

- Pay As You Earn (PAYE): Companies must deduct PAYE from employees’ salaries monthly and remit it to the KRA by the 9th of the following month.

- Installment Tax: This is paid in advance in four equal installments during the accounting period, particularly if the annual tax liability is projected to exceed Kshs. 40,000.

- VAT: Companies making taxable suplies or sales turnover of Ksh. 5, 000, 000 or more within a year must account for Value Added Tax (VAT). VAT registered companies are required to file monthly returns and make payments by the 20th of the following month.

- Withholding Tax: Certain payments made to residents and non-residents may be subject to withholding tax at various rates.

It’s important to maintain accurate records, file returns and comply with all tax deadlines to avoid penalties. For more detailed information, you can refer to the official KRA website or consult with a tax professional.

8. Compliance Requirements for Private Limited Companies

Private limited companies in Kenya are subject to various compliance requirements to ensure they operate within the legal framework of the country. Some key obligations include;

- Auditor : A Private limited company must appoint an auditor who is a member of the Institute of Certified Public Accountants of Kenya unless the directors anticipate that audited financial statements will not be necessary for the company.

- Annual Return: Every company must file a return with the Company Registrar at least once a year.

- Permits and Licenses : Private limited companies operating in specific sectors must obtain relevant permits from regulatory bodies.

- Employment and labor laws : Private limited companies must comply with employment and labor laws regarding minimum wage, working hours, employee benefits, and termination procedures to avoid legal implications or penalties.

- National Social Security Fund (NSSF): Private limited companies must contribute to the National Social Security Fund (NSSF) for their employees, providing social security protection including retirement, disability, and survivor's benefits.

- National Hospital Insurance Fund (NHIF) : Private Limited Companies are required to contribute to the National Hospital Insurance Fund (NHIF) on behalf of their employees. The NHIF is a mandatory health insurance scheme that aims to provide accessible, affordable, sustainable, and quality healthcare for all Kenyan citizens.

- National Industrial Training Authority (NITA) : Private Limited Companies in Kenya must contribute to the NITA Levy at a rate of KSh. 50 per employee per month. Employers with fewer than 100 employees are exempt from NITA registration and payments in the first year after incorporation.

Was this information helpful ?