NITA Levy

Discover everything you need to know about the National Industrial Training Authority (NITA) Levy. Learn about its purpose, benefits, and how it helps promote skills development in Kenya's industrial sector.

1. What is NITA?

The National Industrial Training Authority (NITA), formerly known as the Directorate of Industrial Training (DIT), is a state-owned corporation established under the Industrial Training (Amendment) Act of 2011.

It's core function is to promote the highest standards in the quality and efficiency of Industrial Training in Kenya and ensure an adequate supply of properly trained manpower at all levels in the industry.

2. Explaining the NITA Levy and its Purpose

NITA Levy is a mandatory contribution that employers are required to make towards the National Industrial Training Authority (NITA) in Kenya. Its purpose is to fund and support various training programs and initiatives aimed at enhancing skills development and improving employment opportunities in the country.

The levy helps ensure that employees receive adequate training to meet industry demands, fostering a skilled workforce and driving economic growth.

3. Who is Required to Pay the Kenya NITA Levy?

NITA Levy is a mandatory contribution that employers in Kenya are required to make towards the National Industrial Training Authority.

The Industrial Training Levy Fund was established under Section 5 (Cap. 237) of the Industrial Training Act.

As per regulations, employers in Kenya are mandated to contribute towards the National Industrial Training Authority (NITA) through an annual levy.

4. How is the NITA Levy Fund Calculated?

The levy is calculated at a monthly rate of KSh. 50 per employee, including casual employees.

If an employer has fewer than 100 employees, they are not required to register or make payments within the first year of operation. This exemption applies from the date of incorporation onwards.

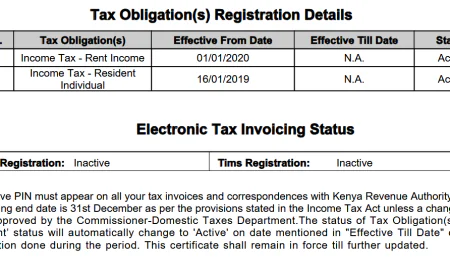

To facilitate this process, the Kenya Revenue Authority (KRA) offers a unified payroll system which serves as the collecting agent for these payments.

5. What are the Benefits of Paying the NITA Levy?

- Reimbursement, in part or in full, for training costs incurred by employees.

- Opportunities for industrial attachments and grants for employers participating in attachment programs.

- Compliance with legal requirements.

6. How often Should Employers Remit the NITA Levy?

Employers are required to remit the monthly levy contribution and file returns for a duration of twelve months starting from the business's registration date. This ensures compliance with regulatory requirements regarding contributions and reporting.

7. NITA Levy Contribution Exemption

The only exemption from NITA levy contributions is for employers who are remitting the tourism levy.

8. What Happens if an Employer Fails to Pay the NITA Levy?

- Failure to comply with the requirement to pay the training levy at the end of each financial year will result in a penalty of 5% of the amount due.

- Failure to comply with the order constitutes an offence that attracts a fine of up to KShs 100,000. In addition, a penalty not exceeding KShs 50,000 applies for every year or part thereof for continuance of non-compliance

9. How can Employers Register and Pay the NITA Levy?

To obtain the employer registration form, please visit the official NITA Kenya website https://www.nita.go.ke or contact your nearest NITA office. It is important to fill out the form accurately and provide all the required information.

10. Useful Links

Was this information helpful ?

Like

1

Like

1

Dislike

0

Dislike

0

Love

2

Love

2

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0