Value Added Tax (VAT)

Among the taxes administered in Kenya, the value added tax (VAT) is one of the prime taxes that impact business owners. This guide will take you through the basics of Kenya VAT—from its rates to registration and returns so you can stay compliant and carry your business forward with ease.

1. Brief Explanation of Value Added Tax (VAT)

Value Added Tax (VAT) is a consumer tax levied on sale or import of taxable goods and services, and is administered by the Kenya Revenue Authority (KRA).

It applies to all goods and services supplied within Kenya for use or consumption, with exceptions for some essential items such as foodstuffs and medical supplies.

The standard rate stands at 16%, while a reduced rate of 14% and 0% applies to certain products such as agricultural inputs, books, and medicines. In addition, there are also exemptions for some activities including exports, international transportation services and government and diplomatic bodies.

2. Who is Eligible for the Value Added Tax in Kenya ?

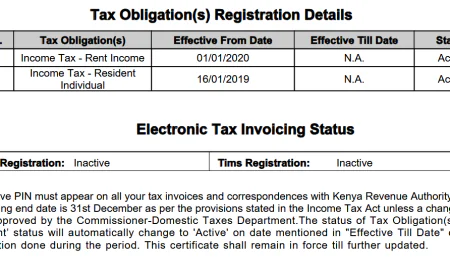

Both individuals and companies may be registered for VAT in Kenya if they make or expect to make taxable supplies or sales of KES 5 million or more in any period of 12 months. Once registered, the person will have a VAT obligation registered against its Personal Identification Number( PIN) with the Kenya Revenue Authority (KRA).

Once registered, businesses are required to file regular VAT returns with the KRA, reporting their output tax (VAT charged on sales) and input tax (VAT paid on purchases). The difference between output tax and input tax represents either a payable amount or a refundable amount, depending on whether there is excess input tax.

3. Registering For Value Added Tax (VAT) in Kenya

Individuals or companies making taxable supplies of Ksh. 5, 000, 000 or more within a year, or starting a business expecting to exceed that amount, must register with the Kenya Revenue Authority (KRA) and get a Personal Identification Number (PIN). Registration should be done within 30 days of becoming liable.

To apply for a Value Added Tax (VAT) tax obligation, the first step is to visit the KRA website at www.kra.go.ke

4. Value Added Tax (VAT) Rates in Kenya

In Kenya, Value Added Tax (VAT) is divided into different categories, namely Exempted Tax and Zero-rated. The supply or importation of certain goods falls under the Exempted Tax category. The standard VAT rate for taxable goods and services, as well as imports, is 16%.

Meanwhile, the rate applied to the local supply of fuel and petroleum oils is 8%. The rate applied to exports, international passenger transport, and zero-rated supplies (such as supplies sent to EPZs, diplomats, and governments) is 0%.

Lastly, any business below the VAT registration threshold is subject to a 3% Turnover Tax

5. Value Added Tax Exempt Goods and Services

- Projects financed by Government development partners only where financing agreements provide for such exemptions.

- Persons with privileges and immunities in accordance with international agreements and conventions.

- Supplies to armed security forces.

- Raw farm produce that has not undergone any processing or value addition excluding cut flowers.

- Live animals, fish and poultry.

- Plant, machinery and equipment used in the construction of a plastics recycling plant.

- Medicaments.

- Financial services, educational services and social services supplied by Government or non-government organizations.

- Goods imported by persons living with disability.

- Goods imported or purchased locally for the use on the construction of houses under the affordable housing scheme.

Zero-rated supplies

- Agricultural pest control products.

- Liquefied petroleum gas, including Propane.

6. Understanding Input and Output VAT Deductions

It is important for businesses to comprehend how input and output VAT works, as it directly impacts their financial transactions and compliance with tax regulations.

Input VAT refers to the tax paid by a business on its purchases of goods, importation or services from suppliers. This includes raw materials, equipment, utilities, and other expenses incurred in the production process. On the other hand, output VAT refers to the tax charged by a business on its sales of goods or services to customers.

Understanding how input and output VAT interact is essential for businesses to accurately calculate their net VAT liability. By deducting the input VAT paid from the output VAT collected, businesses can determine the amount they owe to or can claim from the Kenya Revenue Authority (KRA).

7. Submission of Value Added Tax (VAT) Returns

All individuals and businesses that have registered are obligated to submit a monthly return on or before the 20th day of each month. Even if there is no Value Added Tax (VAT) to declare, a NIL return must be filed.

8. Penalty, Interests and Late Submission of Returns

Failure to submit the tax return by the set deadline, a person may be subject to a penalty of either Ksh. 10,000 shillings or 5% of the tax amount owed, whichever is greater and a late payment interest of 1% per month is incurred.

9. Keeping Records of Receipts Expenses

It's important for businesses to keep accurate records of their transactions, including invoices, sale receipts,contracts agreements,book of accounts and other supporting documents, as these will be required during audits or when filing VAT returns. Failure to comply with VAT regulations can result in penalties or legal consequences.

In conclusion, understanding the basics of Value Added Tax in Kenya is crucial for businesses and individuals alike. By ensuring compliance with VAT regulations, businesses can avoid penalties and contribute to the country's development through proper taxation.

Was this information helpful ?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0