A Comprehensive Guide to Understanding eTIMS

Discover everything you need to know about Kenya's Electronic Tax Invoice Management System (eTIMS) in this comprehensive guide. Learn how eTIMS streamlines tax invoice management processes, improves compliance, and enhances transparency for businesses in Kenya.

1. Background of Electronic Tax Invoice Management System (eTIMS)

The Finance Act 2023 introduced Section 23A in the Tax Procedures Act, 2015, which mandates every person in business to record each sale, issue, and transmit Electronic Tax Invoices (ETI) through an electronic management system.

The law requires that any person claiming a business expense must be supported by an electronic tax invoice. Therefore, all individuals engaged in business, whether registered for VAT or not (non-VAT taxpayers), are required to issue electronic tax invoices.

According to the announcement by the Kenya Revenue Authority (KRA), all taxpayers conducting business, including those not registered for VAT (non-VAT taxpayers) and falling under the Income Tax bracket, were required to onboard eTIMS as from September 1, 2023.

2. Understanding eTIMS: What Exactly is an Electronic Tax Invoice Management System?

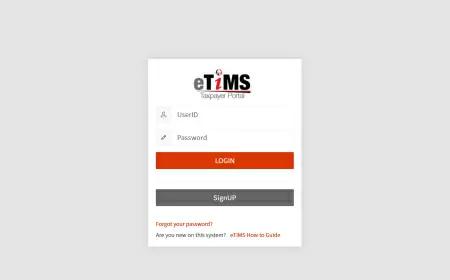

The Electronic Tax Invoice Management System (eTIMS) is a software solution developed by the Kenya Revenue Authority (KRA) to facilitate electronic invoicing and compliance for taxpayers. The software is designed to simplify, streamline, and add flexibility to the process of electronic invoicing for taxpayers in Kenya.

eTIMS is accessible across various computing devices including computers, laptops, tablets, smartphones and Personal Digital Assistants (PDAs), offering convenience at your fingertips.

Video Credit : Spice FM

3. The Benefits of Implementing eTIMS for Businesses by the Kenyan Government

By implementing eTIMS in Kenya, the goal is to improve tax compliance, reduce Value Added Tax (VAT) fraudulent activities and increase overall efficiency in tax administration and revenue collection.

One of the key benefits of eTIMS is its ability to automate the generation, submission, and processing of tax invoices. This not only saves time for businesses but also helps in ensuring accuracy and transparency in tax reporting.

Additionally, eTIMS provides real-time visibility into financial transactions, enabling better monitoring and enforcement of tax regulations.

4. Key Features and Components of the Electronic Tax Invoice Management System in Kenya

The electronic Tax Invoice Management System (eTIMS) consists of various key features and components such as;

- Sales Management : The eTIMS software is designed to facilitate the creation of invoices and the generation of Proforma quotations.

- Purchase Management : The eTIMS software is designed to facilitate the management of purchase invoices, local purchase orders (LPOs) , and suppliers records.

- Customers Management : The eTIMS software is specifically designed to streamline the management of customers records and suppliers, thereby enhancing the efficiency of client handling.

- Stock Management : It is available for persons supplying goods. The eTIMS software supports stock management for both sales (outgoing stock) and purchases (incoming stock). The stock management modules are configured during installation of the software.

These features work together to create a reliable and secure platform for effectively managing tax invoices and ensuring compliance with tax regulations.

5. Who Needs to Register for the Electronic Tax Invoice Management System (eTIMS) ?

It's mandatory for all business entities to integrate with eTIMS and issue electronic tax invoices. Businesses and individuals that are required to register include:

- Companies, partnerships, sole proprietorships, associations, and trusts.

- Individuals both resident and non-resident with income tax obligations including Monthly Rental Income (MRI) Tax and Turnover Tax (TOT).

- Individuals conducting business in various sectors, including the informal sector.

- Businesses, whether or not registered for VAT, such as entities supplying VAT exempt goods and services (e. g hospitals, schools, tours and travel agents, NGOs), are also required to onboard on eTIMS.

Non-resident suppliers of digital services are exempt from issuing electronic tax invoices but must provide invoices or receipts for value and tax charged.

6. Software Solutions Available for Onboarding onto eTIMS.

There are software solutions accessible for integration with eTIMS. The solutions available include:

-

eTIMS Lite (Web) - Web based solution accessible through eCitizen Platform. This solution is for businesses with minimal transactions.

-

eTIMS Lite (USSD) - Accessed through the short code *222#. This solution is for individuals and sole proprietors.

-

Online Portal- Tailored for taxpayers in the service sector exclusively, where no goods are supplied.

-

eTIMS Client – A downloadable software designed for taxpayers dealing in goods or both goods and services. The software supports multiple branches and pay points/cashier tills.

-

Virtual Sales Control Unit (VSCU) – This solution enables seamless system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS, catering to taxpayers with extensive transactions or bulk invoicing.

-

Online Sales Control Unit (OSCU) – This solution also facilitates system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is ideal for taxpayers using an online invoicing system.

7. Compliance Timelines

VAT registered persons should have already onboarded on eTIMS. Non-VAT registered persons have until 31st March 2024 to onboard. From 1st January 2024, all business expenses must be supported by an electronic tax invoice.

8. Conclusion

In conclusion, the implementation of eTIMS technology in Kenya brings numerous advantages for both businesses and the government. It modernizes tax processes, enhances compliance levels, reduces paperwork burden, and boost more revenue collection.

Was this information helpful ?