Digital Service Tax

This guide explores the Significant Economic Presence Tax (SEPT), formerly known as the Digital Service Tax (DST), in Kenya, providing guidance for business owners and foreign investors. We will cover what DST is, who it affects, how it's calculated, and the steps for compliance. By understanding these aspects, businesses can operate legally while minimizing negative impacts on their tax compliance requirements in Kenya.

1. Significant Economic Presence Tax (SEPT)

The Tax Laws Amendment Act of 2024 introduced the Significant Economic Presence Tax (SEPT), replacing the Digital Services Tax (DST) effective from December 27, 2024.

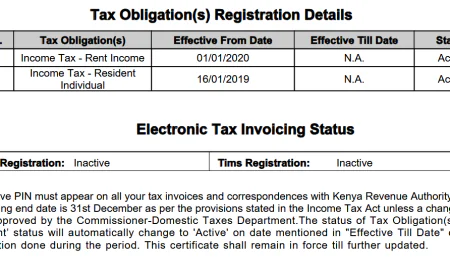

New taxpayers registering for this regime are assigned SEP tax obligations.

The iTax system was updated to implement SEPT instead of DST, effective from December 27, 2024.

2. What is Digital Service Tax (DST) and Why Was it Introduced in Kenya?

Digital Services Tax (DST) is a tax on digital services that are provided by individual, companies and businesses. This tax is levied on the revenue earned in Kenya from specific digital services, digital marketplace or a business that is offered over the internet or an electronic network in Kenya.

The DST aims to ensure that companies pay their fair share of taxes in Kenya where they operate and provide services, especially when they have a significant economic presence but do not have a physical presence.

3. Who Is Liable To Pay Digital Service Tax (DST) ?

Digital Services Tax (DST), is a tax that is imposed on certain digital services provided to customers in Kenya by non-resident individual, companies or businesses established in Kenya.

Any non-resident persons or overseas companies providing digital services or digital market place to a user in Kenya is required to appoint a tax representative in Kenya who become responsible for remitting the DST to Kenya Revenue Authority (KRA) on their behalf

4. What DST Services are Taxable in Kenya ?

Digital marketplace can be referred as a platform that enables the direct interaction between buyers and sellers of goods and services through electronic means. The services covered under DST vary but generally include :

- Downloadable digital content i.e. downloadable mobile applications, e-books and films.

- Streaming television shows, films, music, podcasts and any form of digital content.

- Subscription based media such as news, magazines and journals.

- Website hosting, online data warehousing, file-sharing and cloud storage services.

- Online booking, online ticketing services and online sale of tickets.

- Provision of search engine and automated help desk services.

- E-learning including online courses and, online distance learning and online trainings.

- Any other service provided through a digital marketplace.

5. Income Exempted from Digital Service Tax (DST)

- Income that is subject to withholding tax.

- Income earned by a non-resident individual who is in the business of transmitting messages through various methods of communication (cable, radio, optical fiber, television broadcasting, Small Aperture Terminal (VSAT), internet, satellite).

- Income earned through online services that facilitate payments, lending, or trading of financial instruments, commodities, or foreign exchange. This includes financial institutions listed in the Fourth Schedule of the ITA and financial service providers authorized by the Central Bank of Kenya.

- Lastly, are online services provided by government institutions.

6. How is DST Calculated and What are the Rates in Kenya?

DST is calculated at a rate of 1.5% of the gross transaction value of the digital service.

This is the payment received for services in the provision of digital services, the commission or fee paid to the digital marketplace provider for the use of the platform in this case the digital marketplace.

The gross transaction value is exclusive of Value Added Tax (VAT).

7. Submission of Digital Service Tax (DST) Returns

The DST return and tax payable is due on or before the 20th day of the month following the end of the month that the digital service was offered.

8. Can DST Paid Be Set Off Against Income Tax Payable?

DST paid cannot be offset against income tax on digital services provided by non-resident person. It is not considered a deductible expense for income tax purposes. Therefore, you cannot use the amount of DST paid to reduce your annual income tax liability.

Resident and non-resident individuals with permanent residency in Kenya can offset against tax payable by the person for that year of income.

Non-resident companies without any permanent establishment in Kenya can claim tax paid in Kenya under a special arrangement as a credit against tax chargeable on that income in their country of residency and where the company is incorporated.

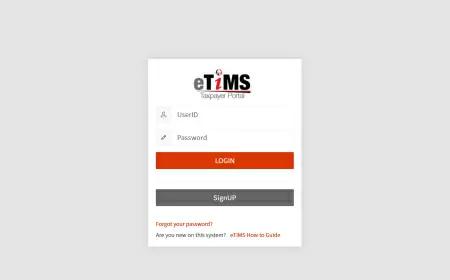

9. How to Register For Digital Service Tax (DST) in Kenya

Registration of Digital Service Tax (DST) can only be done online on the Kenya Revenue Authority (KRA) iTax portal. A taxpayer can only be able to make payments and file DST returns after registering for DST on iTax.

Upon successful registration, the Kenya Revenue Authority (KRA) issue the applicant with a Personal Identification Number (PIN) for the purpose of filing returns and payment of DST.

If no tax representative is appointed, the KRA Commissioner may appoint a digital service tax agent to be collecting and remitting to the DST to the Commissioner.

10. Penalty, Interests and Late Submission of DST Returns

- Failure to submit DST return by the due date is charged 5% of the tax due.

- Failure to pay DST by the due date attracts a penalty of 5% of the unpaid tax.

- Interest is charged at 1% per month or any part thereof on any unpaid tax.

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0