Withholding Tax

In this article, we will delve into everything you need to know about withholding tax in Kenya. We will discuss the types of income subject to withholding tax, the rates applicable for different categories of taxpayers, exemptions available under the law, and procedures for filing returns and obtaining refunds. Whether you are a business owner or an individual taxpayer earning income subject to withholding tax, this section will provide you with valuable insights into navigating the Kenyan taxation landscape.

1. Introduction to Withholding Tax in Kenya

Withholding tax is a form of tax that is withheld or deducted from payments made to certain individuals or entities for services rendered, goods supplied, or rent paid. This form of taxation helps the government in collecting taxes due on income earned by individuals and businesses.

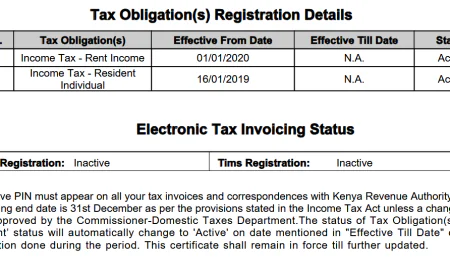

The amount of withholding tax varies depending on the type of payment and the taxpayer's residency status. In Kenya, withholding tax is collected at source when payments are made to suppliers, contractors, and other service providers.

It also applies to dividends, Interest, Royalties, Management or professional fees (including consultancy, agency or contractual fees), Commissions, Pensions and as well as rental income earned by non-residents landlords. Understanding how withholding tax works in Kenya can help taxpayers plan their finances better and ensure compliance with the law.

2. The Different Types of Withholding Taxes in Kenya

VAT Withholding Tax

Withholding VAT refers to the VATable amount that is deducted at source by registered taxpayers when making payments to suppliers or service providers. The withheld amount is then remitted to the Kenya Revenue Authority (KRA) on behalf of the supplier.

The tax is withheld at a rate of 2% of the total amount payable.

Rental Income Withholding Tax

This tax applies to rent paid by residential property and commercial property. The agents withhold tax at a rate of 10% of gross rent paid to resident landlords and remit it to KRA by 20th day of the month following rent payment.

For non-residents individuals, the tax is withheld at a rate of 30% of the gross rent and it is a as a final tax, the tax is not subject to any further taxation.

Withholding Income Tax

Withholding Income Tax is tax withheld and deducted from certain income sources of a person. The person making the payments deducts tax at the applicable rate and remits the tax to the Kenya Revenue Authority (KRA) on behalf of the recipient (the person being paid).

Some examples of income payments subject to withholding tax include : -

- Management Fees

- Royalties and Interests

- Dividends

- Consultancy Fees

- Contractual Fees

- Lottery and Betting Winnings

3. Withholding Tax Rates in Kenya

The rates for withholding tax vary depending on the type of payment and whether the recipient is a resident or non-resident.

4. How To Pay Withholding Tax

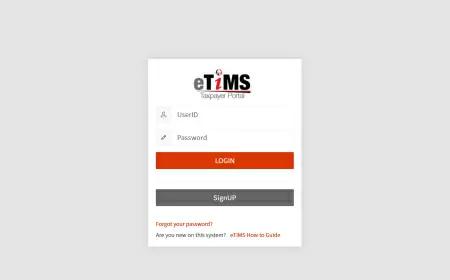

Payment of withholding tax is done online on the Kenya Revenue Authority (KRA) iTax Portal. To make the payment you are required to generate a payment slip and present it at any of the appointed Kenya Revenue Authority (KRA) banks, alternatively you can pay also using mobile money.The tax payment remittance due date is on or before the 20th day of the month.

Once the payment has successfully been remitted to KRA, a Withholding Certificate is autogenerated and sent to the email registered with on iTax.

5. Penalty, Interests and Late Submission of Witholding Tax Returns

A late payment penalty of 5% and interest of 1% per month apply on the tax due for the period that the tax remains unpaid.

Was this information helpful ?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0