What is a Personal Identification Number (PIN) in Kenya?

A Personal Identification Number (PIN) is a distinctive number provided by the Kenya Revenue Authority, essential for tax-related activities. Both individuals and businesses need this PIN to file taxes, apply for licenses, and access a range of government services in Kenya. Understanding the registration requirements is important for compliance and efficient service access.

1. What is a KRA Personal Identification Number (PIN) in Kenya?

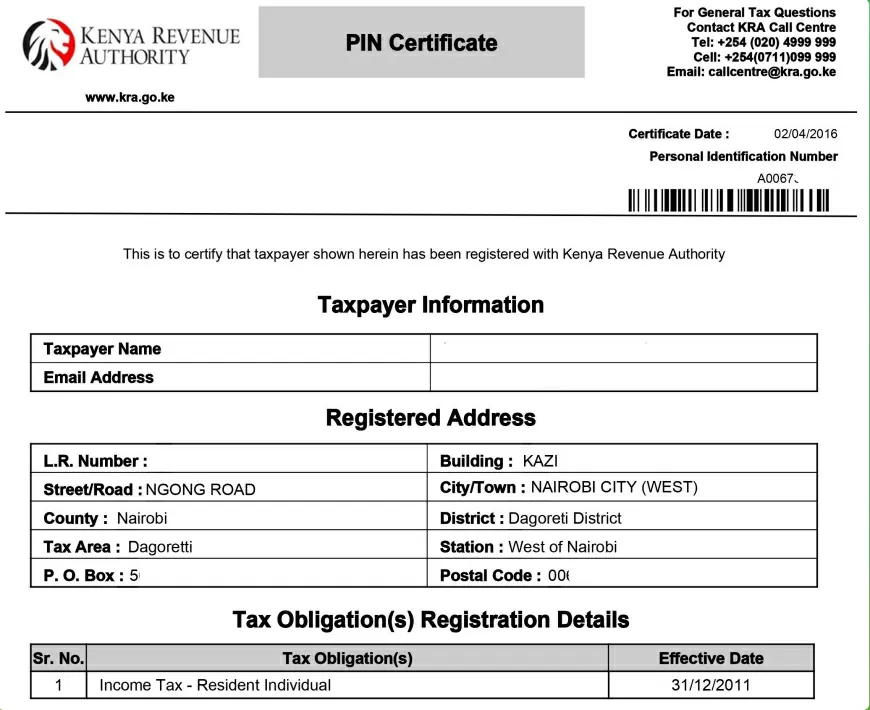

A Personal Identification Number (PIN) is a unique 11-digit number issued by the Kenya Revenue Authority (KRA) to identify taxpayers in Kenya, including both individuals and entities.

It serves as a unique identifier for individuals and entities when conducting transactions with the Kenya Revenue Authority, various government agencies, and service providers.

2. How is a KRA PIN used in Kenya?

A KRA PIN is necessary and commonly used in Kenya for filing tax returns, making tax payments, and accessing government services and programs.

3. Who is Required to have a KRA PIN in Kenya?

The requirement for a KRA PIN applies to several individuals and entities in Kenya. The following individuals are required to obtain a PIN:

- Kenyan citizens over 18 years of age must obtain a KRA PIN, including those employed, self-employed, or engaged in income-generating activities.

- Foreign nationals living or working in Kenya, including expatriates, investors, and those generating income from Kenya.

- Businesses and organizations operating in Kenya, whether local or foreign-owned, must register for a KRA PIN.

- Specific transactions, such as property purchases or sales, vehicle registration, and opening bank accounts, also require a valid KRA PIN.

4. How does one Apply for and Obtain a KRA PIN in Kenya?

To apply for and obtain a KRA PIN in Kenya, follow these steps:

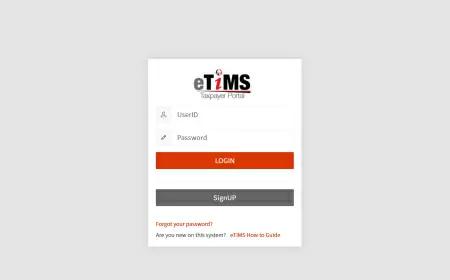

- Registration is done on iTax Portal

- Visit the official Kenya Revenue Authority (KRA) iTax portal.

- Navigate to the New PIN Registration section.

- Choose taxpayer type as individual (for personal PIN) or non-individual (for corporates and businesses), and select online form as the mode of registration.

- Create an account by providing necessary personal information.

- Fill out the required forms with accurate information.

- Submit supporting documents as requested.

- Verification

- KRA will review your application and verify the provided information.

- This process may take a few business days.

- PIN Issuance

- Upon successful verification, KRA will issue your PIN by sending it via email.

- You can also download your PIN certificate from the iTax portal.

- Activation

- Your PIN becomes active immediately upon issuance.

- You can now use it for various tax-related activities and transactions.

5. What Information is Required to Register for a KRA PIN in Kenya?

To obtain a KRA PIN, the following identification documents are required:

- Kenyan Residents

- A valid National ID card

- For non-Kenyan Residents

- A valid Alien ID card

- For Non-Kenyan Non-residents

- A valid Passport

- For Non-Individuals (companies, businesses and organizations)

- Certificate of registration or incorporation

These identification documents are essential for KRA to verify the applicant's identity and legal status. The specific document required depends on the residency status of the person or the entity's legal structure.

6. Are There any Fees Associated with Getting a KRA PIN in Kenya?

The PIN Certificate is issued free of charge by the Kenya Revenue Authority (KRA).

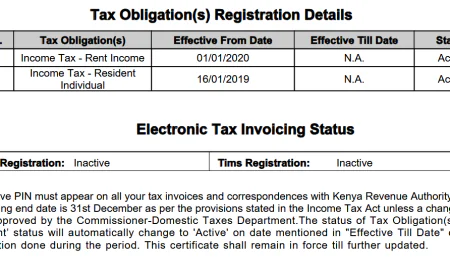

7. Types of Tax Obligations Registration a Person Can Register

Some of the tax obligations and registration categories that individuals and businesses may need to consider include:

- Income Tax (Resident/Non-Resident)

- Mandatory for both resident, non-resident individuals and companies.

- Purpose: Declaring income earned within a specified timeframe

- Pay As You Earn (PAYE)

- Required registration for employers.

- Involves withholding and remitting income tax on behalf of employees.

- Turnover Tax

- Applicable to businesses with annual turnover not exceeding KES. 5 million.

- Designed for informal sector entities with basic tax procedures and record-keeping

- Value Added Tax (VAT)

- Mandatory for businesses supplying or expecting to supply taxable goods and services valued at KES 5 Million or more annually.

- Voluntary registration option available.

8. How can a Person Verify their KRA PIN in Kenya?

To verify a KRA PIN in Kenya:

- Access the iTax Online eServices on the iTax Portal.

- Use the PIN Checker section to confirm if a PIN is genuine and active.

- The PIN Checker provides basic taxpayer details, as the information is limited.

9. Useful Links

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

2

Wow

2