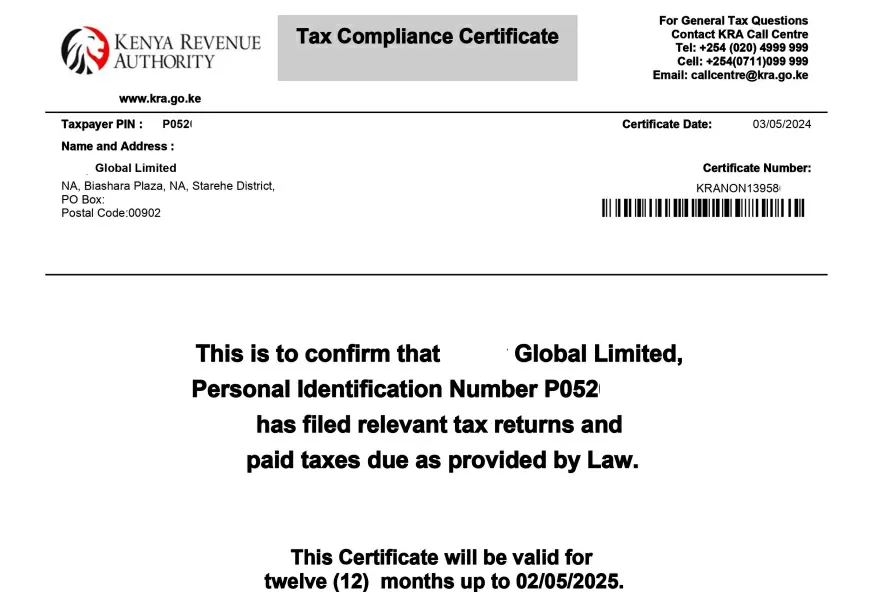

Tax Compliance Certificate

A Tax Compliance Certificate (TCC) is an essential document for businesses and individuals operating in Kenya. It proves that a taxpayer has met their tax obligations and is in good standing with the Kenya Revenue Authority (KRA). Maintaining a valid TCC should be a top priority for anyone seeking to engage in business or transact with service providers in the country.

1. What is a Tax Compliance Certificate (TCC) in Kenya?

A Tax Compliance Certificates (“TCC”) is an official document that is issued by the Kenya Revenue Authority ( KRA) to individuals and corporate bodies as confirmation that such individuals and corporate bodies have filed relevant tax returns and paid taxes due as provided by law.

2. Why is a Tax Compliance Certificate Required in Kenya?

The Kenya Revenue Authority (KRA) issues TCCs to verify that a person and businesses have fulfilled their tax obligations. This certificate serves as official documentation that the holder is in good standing with Kenyan tax laws and regulations.

3. Who Needs to Obtain a Tax Compliance Certificate

Tax Compliance Certificates (TCCs) in Kenya are issued by the Kenya Revenue Authority (KRA) for various purposes. Individuals and entities may need to obtain a TCC in the following situations:

- Employment: Job applicants are required to present a TCC upon receiving a job offer.

- Government Tenders: Applicants for government tenders and contracts must submit a valid TCC.

- Work Permit Renewal: Foreign nationals seeking to renew their work permits in Kenya need a TCC.

- Clearing and Forwarding Agents: Those applying for a license in this field must provide a TCC.

- Liquor Store Operations: A person or business seeking a license to operate a liquor store are required to submit a TCC.

- Personal Compliance Verification: A person or business may request a TCC to confirm their tax compliance status.

- Regulatory Requirements: Various other regulatory bodies may require a TCC for specific purposes.

4. How to Obtain a Tax Compliance Certificate in Kenya

To obtain a Tax Compliance Certificate, taxpayers must meet the following requirements:

- Timely Filing of Tax Returns: All applicable tax returns must be submitted on or before their respective due dates.

- Payment of any Tax Due: Tax payments must be made on or before the specified due dates for each tax obligation.

- Debt Clearance: Any outstanding tax debts must be fully settled.

Obtaining a Tax Compliance Certificate (TCC) in Kenya involves a straightforward process. Here is a brief procedure of what you need to know:

- The Application Process

- The application for a TCC is conducted through the iTax platform.

- Once processed, the certificate is sent directly to the applicant's email address.

- Verification Method

- A person can verify their TCCs on iTax Online eServices section.

- Alternatively, you can check the validity of your Tax Compliance Certificate using the KRA M-Service App.

5. Tax Compliance Certificate Validity

Tax Compliance Certificates are valid for 12 months from the date of issuance.

6. Useful Links

Was this information helpful ?