Registering a Business on iTax

This comprehensive guide provides a step-by-step walkthrough of the business registration process on the iTax platform. It covers the essential steps for obtaining a KRA PIN for companies and offers insights to ensure a smooth and efficient registration experience.

1. Access The iTax Portal

To begin the registration process, a new taxpayer can access the iTax portal by visiting the official website at https://itax.kra.go.ke.

Once on the portal, the user should locate and click on the 'New PIN Registration' icon.

2. Choose The Registration Type

The registration type selection for Non Individual process include:

1. Taxpayer Type

- Navigate to the 'Taxpayer Type' drop-down menu

- Select the 'Non Individual' option

2. Mode of Registration

- Locate the 'Mode of Registration' drop-down menu

- Choose the 'Online Form' option

These selections will determine the appropriate registration pathway for non-individual entities using the online registration form.

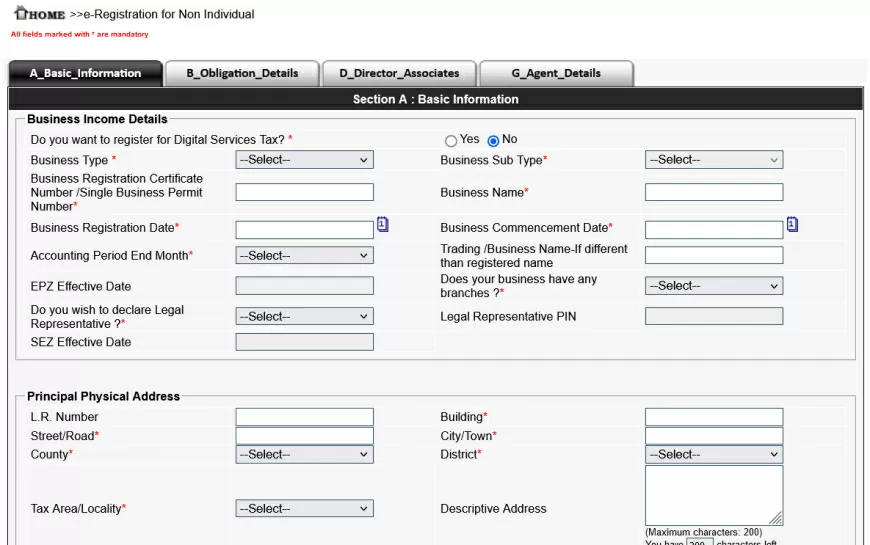

3. Enter Business Information

To complete this section, the taxpayer is required to input their business information into the designated text boxes.

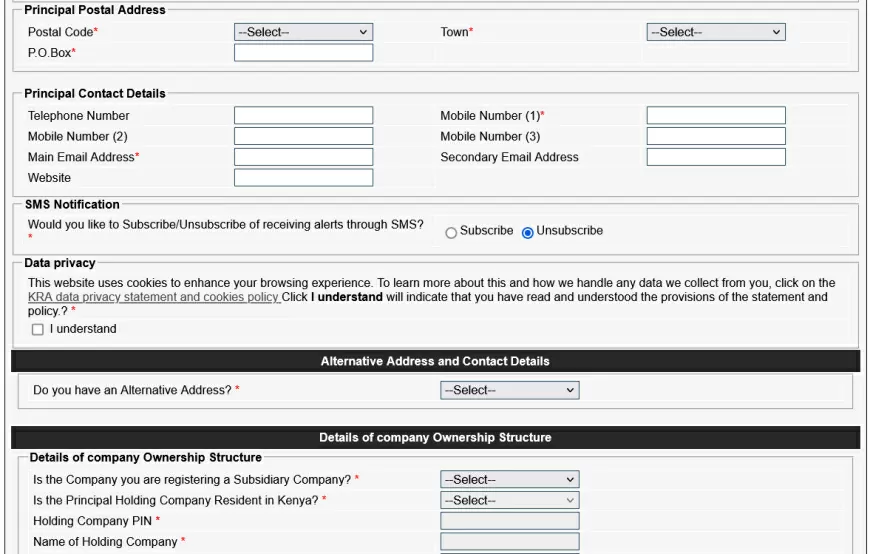

4. Verify Your Identity

To verify your identity and contact details, please follow these steps:

1. Enter Principal Contact Details

- Main Email Address

- Mobile/Contact Numbers

2. Click on "Send OTP" (One Time Password)

- An OTP will be sent to the main email address you provided.

3. Enter the OTP

- Input the received OTP in the 'One Time Password' text box.

This process ensures secure access to your account and protects your personal information. Please ensure all details are entered accurately to avoid any delays in the verification process.

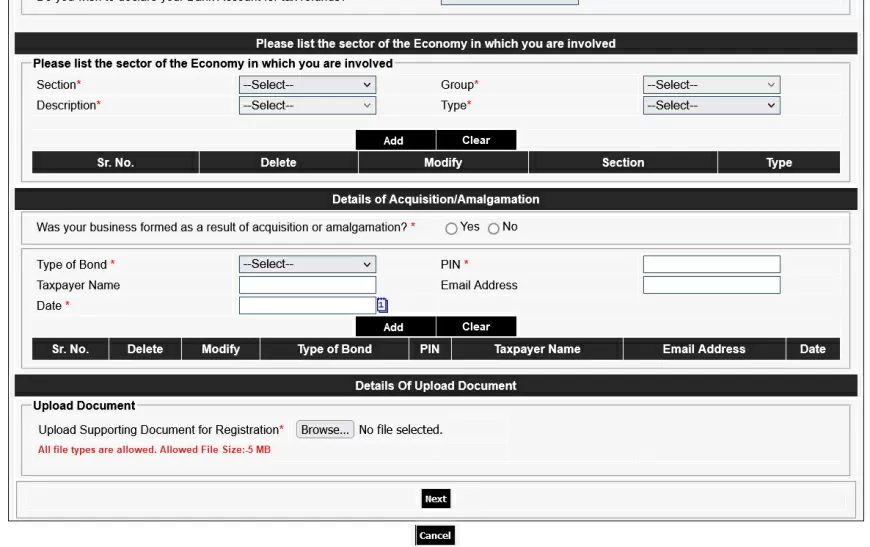

5. Upload The Necessary Supporting Documents for Registration.

To complete the business information registration details, please follow these steps:

1. Upload the required supporting documents

- Certificate of incorporation

- Registration identification certificate issued to your business.

Note: Combine these documents into a single PDF file before uploading.

2. Fill in the following information

- Alternative address and contact details.

- Details of company ownership structure.

- Bank account information.

Once you have uploaded the documents and filled in the necessary details, click the 'Next' button to proceed.

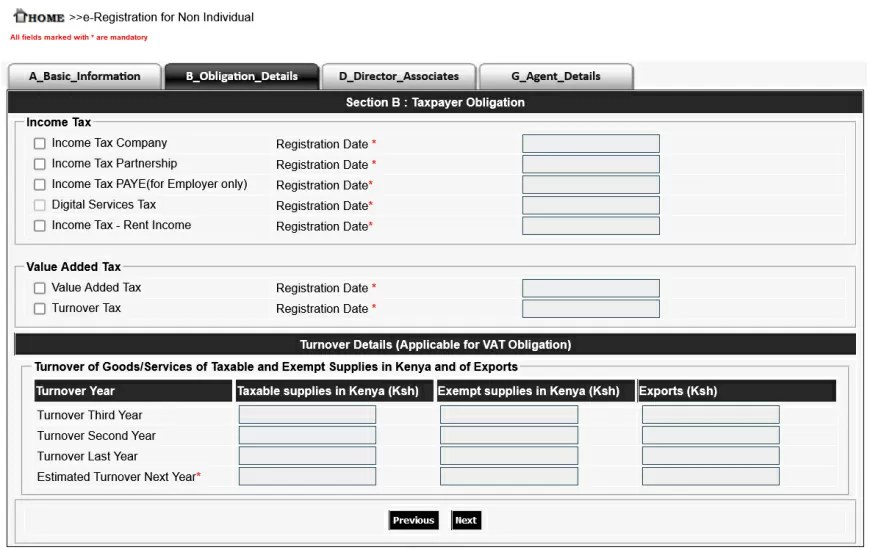

6. Tax Obligation Details

Choose the tax obligation appropriate for your business that you want to register. Select the registration date for the tax obligations.

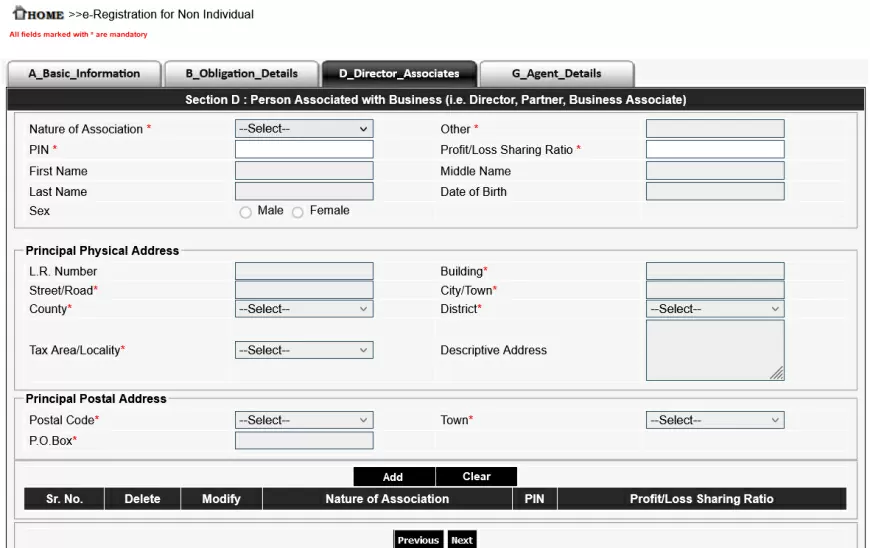

7. Directors Details

Fill in the details of the person associated with the business (i.e., Director, Partner, Business Associate).

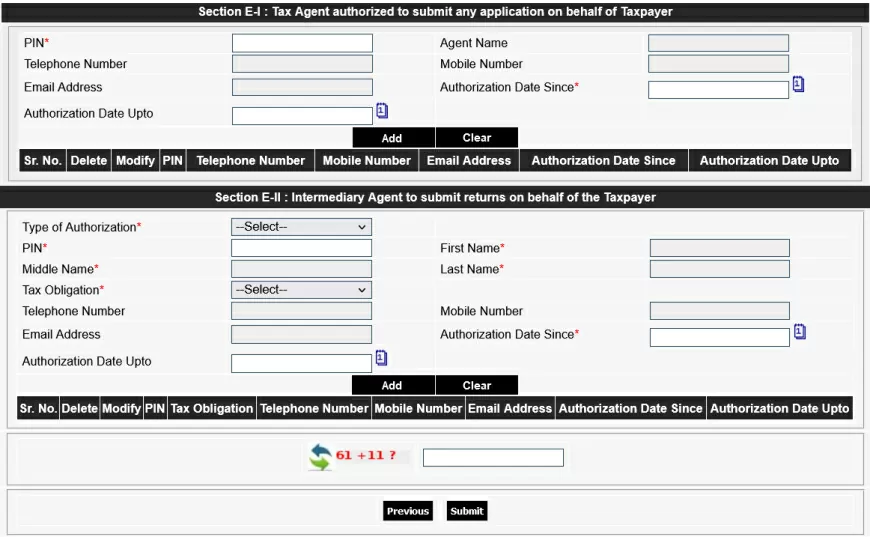

8. Tax Agent Information

Agent details is applicable when the taxpayer has appointed a tax agent or intermediary agent resident in Kenya to submit applications or returns on their behalf.

9. Submit The Required Documents, Review and Confirm.

To complete the application process, please follow these steps:

- Upload all required supporting documentation.

- Carefully review all entered information to ensure accuracy.

- Submit your application by clicking the submit button.

- Upon submission, you will receive an acknowledgement receipt confirming your application.

Once your application is approved, the KRA PIN and password to activate your iTax account will be sent to your registered email address.

10. Useful Links

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

1

Wow

1