Non-Resident Tax PIN Registration

This comprehensive guide aims to simply the process of Non-Resident Tax PIN registration in Kenya. It provides step-by-step instructions and valuable information to help individuals understand and navigate through the process effectively.

1. Understanding Non-Resident Tax PIN and its Importance

A Non-Resident Tax PIN (Personal Identification Number) is a unique identifier used by individuals who are non-residents for tax purposes. This number is important as it allows non-residents to file their taxes and claim any relevant deductions or credits they may be eligible for. It helps ensure accurate reporting of income and compliance with tax laws in Kenya.

2. Who Needs to Register for a Non-Resident Tax PIN in Kenya?

In Kenya, individuals and entities that are not residents but engage in income-generating activities within the country are required to register for a Non-Resident Tax PIN.

Foreign individuals who earn income from sources within Kenya, such as rental income, employment or business profits derived from activities conducted in the country, need to obtain a Non-Resident Tax PIN.

Similarly, non-resident entities that generate income within Kenya through business operations or investments are also required to register for this PIN.

3. Types of Non-Resident Tax Categories

Foreign individuals' taxes fall into two categories:-

-

A non-Kenyan resident is a Kenyan citizen who lives outside the country. They retain their citizenship rights and privileges, including property ownership, employment, and access to social services. These individuals may have tax obligations on income earned in Kenya.

-

A non-Kenyan non-resident is a foreigner visiting Kenya for tourism or business. They face different tax rules than residents and are usually taxed only on income earned in Kenya, with possible exemptions based on their home country and existing tax treaties.

4. The Process of Registering for a Non-Resident Tax PIN in Kenya

A person is required to have certain documents for the process to be initiated. Individuals can apply at KRA offices, online on the iTax Portal, or through authorized tax agents.

1. Documentation Needed for Registration : To begin the process, non-resident applicants must first gather all the required documents, such as:

- A Valid Passport.

- Work Permit - The work permit should be endorsed in the passport and clearly display the employer's name.

- An introduction letter from the employer confirming the applicant's non-resident status.

- Tax PIN of the employer or employer’s representative and PIN of representative.

- A copy of endorsed original resident permit or a special pass of applicant.

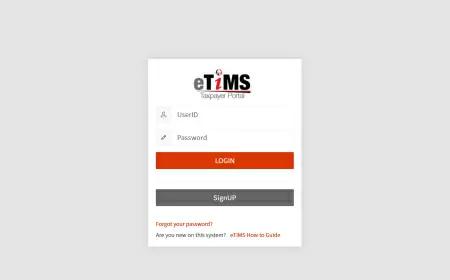

2. To register for a new PIN online:

- Visit the KRA iTax Portal and select New PIN Registration.

- Select "Individual" as your taxpayer type.

- Fill out the online registration form, including your citizenship status under Section A.

- Complete the Obligation details in Section B and Source of income in Section C.

- Attach the required documents to ensure efficient processing.

- Alternatively, you can send scanned documents to KRA Email Address (callcentre@kra.go.ke ) to expedite the process.

- Once approved, the Tax PIN certificate is sent via email.

Was this information helpful ?