Income Tax Company

This comprehensive guide will provide you with everything you need to know about Kenya income tax for companies (Corporation Tax). We will discuss the different types of taxes, tax rates, filing requirements, and important deadlines. Whether you are a new business owner or an established company, this guide will help you navigate through the complexities of Kenya's income tax system and make informed decisions to optimize your tax obligations.

1. Learn Basics of Kenya Income Tax for Companies

Income tax in Kenya is a compulsory tax obligation that applies to either residents or non-residents and corporate businesses that is charged for each year of income upon all the income of an individual or profits of a business derived from Kenya.

In Kenya, companies are subject to income tax based on their annual profits. The Kenyan income tax system is governed by the Income Tax Act Cap 470 and administered by the Kenya Revenue Authority (KRA).

The first step in understanding Kenya income tax for companies is knowing the different types of taxes that apply. The main type of tax applicable to companies is corporate income tax, which is levied on the profits earned by a company during a financial year.

The most common types of Kenyan income tax is derived from:

- Gains or profits from a business

- Employment or services rendered.

- Property and Rentals Income.

- Dividends or Interest payments.

- Digital marketplace income.

- Management and professional fees.

2. Income Tax Company Rates in Kenya

All companies operating in Kenya are subject to income tax on their profits earned during a financial year.

The standard corporate income tax rate is 30% of taxable profits and for branches of foreign companies is 37.5%.

3. Registering for a Corporate Personal Identification Number (PIN)

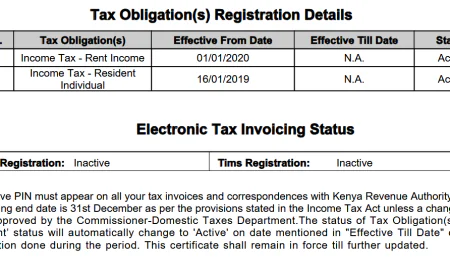

Companies are required to register for income tax with the Kenya Revenue Authority (KRA) and obtain a Personal Identification Number (PIN).

To apply for a Corporate KRA PIN certificate, the first step is to visit the KRA iTax website at www.kra.go.ke

4. Filing Income Company Tax Returns in Kenya

Companies are required to file an annual return with the Kenya Revenue Authourity (KRA), providing details of their income, expenses, and deductions. This information helps determine the taxable profit and subsequently calculate the amount of corporate income tax owed.

It is crucial for companies to maintain accurate records and ensure compliance with accounting standards in order to accurately report their financial information.

Companies must file income tax returns annually, within six months of their financial year end. The financial year end for most businesses and companies in Kenya is on or before 30th June.

5. Late Returns Filling Submission Penalties

Whichever is higher between, 5% of the tax due or Kshs. 20,000.

6. Some of the Key Aspects of Companies Income Tax in Kenya include:

Allowable Deductions

Businesses can deduct all expenses wholly and exclusively incurred in generating taxable income. This includes costs like salaries, rent, utilities, loan interest, depreciation, etc.

Capital Allowances

Capital expenditures like machinery, equipment, and buildings can be written off through capital allowances over a period of time. There are different rates for different types of assets.

Withholding Tax

Businesses are required to withhold tax on payments to suppliers, individuals and contractors, and remit this to the KRA on a monthly basis. The withholding tax rates vary from 3 % to 25%.

Value Added Tax (VAT)

Businesses with annual turnover above KES 5 million must register for VAT and charge VAT on their sales. The standard VAT rate is 16%. Input VAT can be claimed against output VAT.

Tax Incentives

The Kenyan government offers various tax incentives to encourage investment and growth of certain sectors. These include reduced corporate tax rates, capital allowance enhancements, and import duty exemptions.

Businesses must keep proper records of their income and expenses to support the tax returns filed with the KRA. Non-compliance can result in penalties and interest being charged by the KRA. Professional tax advice is recommended to ensure businesses are compliant with all relevant tax laws in Kenya.

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0