How to Apply for Registration of a PIN in Kenya

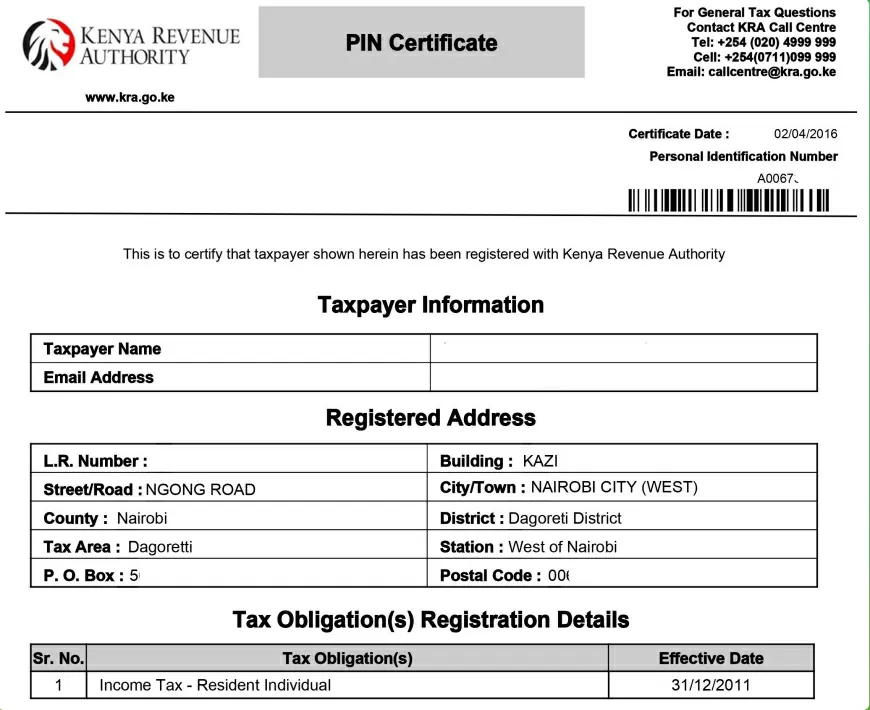

A Personal Identification Number (PIN) is a unique number provided by the Kenya Revenue Authority, essential for tax-related activities. Understanding the step-by-step registration procedure is essential for compliance and efficient service access.

-

What is a KRA Personal Identification Number (PIN)

A Personal Identification Number (PIN) is a unique 11-digit number issued by the Kenya Revenue Authority (KRA) to identify taxpayers in Kenya, including both individuals and entities.

It serves as a unique identifier for individuals and entities when conducting transactions with the Kenya Revenue Authority, various government agencies, and service providers.

READ MORE: What is a Personal Identification Number (PIN) in Kenya

-

Who Needs a PIN in Kenya

A Personal Identification Number (PIN) is required for all residents who are 18 years of age or older and possess valid identification documents.

This requirement ensures that a person is properly registered for tax purposes and can engage with the Kenya Revenue Authority, other government agencies, and service providers within the country.

-

Documents Needed for PIN Application

To register, you need various documents and information depending on your status. Here's a detailed breakdown of the required documents:

1. Kenyan Residents / Citizens

- National ID/Alien ID Card details.

- Employer's PIN for employed individuals.

- Business registration certificate for business owners.

2. Non-Kenyan Employee (Residing in Kenya)

- Introduction letter from the employer.

- Employer's or representative's PIN and Tax Compliance Certificate.

- Original valid passport with endorsed work permit and employer’s name.

- KRA PIN application acknowledgment receipt.

3. Non-Resident Employee or Professional (working in Kenya for up to three months)

- Introduction letter from the employer.

- Employer’s or representative’s PIN and Tax Compliance Certificate.

- Valid Special Pass with endorsement in the passport showing employer’s name.

- KRA PIN application acknowledgment receipt.

4. Employees of Organizations (e.g., UN, UNICEF)

- Endorsement by Ministry of Foreign Affairs on organization letter to KRA.

- Original Passport/ID card confirming immigration exemption status in passport.

5. Employees of Related Institutions (e.g., JICA, IFC)

- Letter of introduction by the employer with their PIN.

- Endorsement by Ministry of Finance with gazette notice copy.

6. Diplomats Residing in Kenya

- Ordinary original passport and diplomatic card endorsed by Ministry of Foreign Affairs.

7. Non-Resident Married to a Kenyan Citizen

- A marriage certificate

- identity card of the Kenyan spouse and their KRA PIN details.

- A dependent pass endorsement for legal recognition and residency purposes.

8. Non-Citizen Students or Interns

- Valid Passport/student pass endorsements.

- An introduction/admission letter from institution as per student pass requirements.

9. British Army Personnel

- Introduction letter from British Peace Support team.

- Memorandum between Kenyan/British Government proof required.

10. Refugees Residing in Kenya - Employed or In Business

- Valid Refugee ID

- Any letters from Department of Refugees Affairs/employer/business registration certificates needed if applicable

- Work permit class M documentation.

11. Non-Kenyan and Non-Residents Investors Residing outside Kenya

- Letter of Introduction from the tax agent.

- PIN of a registered tax agent.

- Valid Tax Compliance Certificate of the tax agent.

- Original and copy of valid passport

- Investments above KES 10 million should get a letter from Kenya Investment Authority (KenInvest).

- Investments below KES 10 million should get a class G permit from the immigration

- Documentary proof of investment (Certificate of Incorporation/Compliance, CR12, project proposal, Endorsement by Kenya Investment Authority (KenInvest), etc.).

12. For Property Purchases and Parcels of Land, necessary documents include;

- Original and copy of a valid passport.

- Copy of the Title Deed or Lease and Deed Plan.

- Sale Agreement signed by all involved parties.

- Introduction Letter from a tax agent.

- Letter of Appointment for the tax agent by the applicant.

- PIN Certificate of a registered tax agent.

- Valid Tax Compliance Certificate for the tax agent.

13. Missionaries

- An introduction letter from your church or diocese.

- The KRA PIN Certificate of the church.

- The original passport and a copy.

- The original class I missionary permit issued by Kenya immigration along with a copy.

- A copy of the endorsed page of the permit as it appears in your passport.

-

How to Apply for the KRA PIN

Image Credit : itax portal by by Kenya Revenue Authority To register for a Kenya Revenue Authority Personal Identification Number (KRA PIN), applicants have two options, in-person or online.

In-Person Registration Applicaton

- Visit any local KRA office with the necessary documents listed under the "Required Documents" section.

- Submit your documents to a KRA official at the service desk for verification.

- Provide all required details as requested by the officer, who will complete your registration form.

- Once verified, the officer will finalize your registration and issue your KRA PIN certificate on the spot, typically within 5 to 10 minutes.

Online KRA iTax Portal Registration

- Access the Kenya Revenue Authority iTax portal.

- Click "Register" under “Do you want to apply for a PIN?” or use the hyperlink next to “To get a new PIN.”

- On the e-registration page, select "Individual" or "Non-individual" under “Taxpayer Type” based on your needs.

- Choose "Online" from the Mode of Registration drop-down menu and proceed by clicking “Next.”

- Fill out all required information on each page of the online form, including Basic Information and Obligation Details.

- Upload supporting documents as instructed and continue through each section until reaching Agent Details (if applicable).

- Complete any CAPTCHA verification and submit your application.

- You’ll receive confirmation via email with instructions to download your KRA PIN Certificate.

-

Application Fees and Validity

- Fees : There is no fee required when making the application.

- PIN Validity : The Personal Identification Number remains valid indefinitely.

-

Important Information about KRA PINs

- A PIN is essential for conducting business with the Kenya Revenue Authority, other government agencies, and various service providers.

- When applying for a KRA PIN, you must choose a tax obligation from the following options:

- Income Tax: This is a mandatory obligation applicable to both residents and non-residents.

- Value Added Tax (VAT): This applies to suppliers of taxable goods and services.

- Pay As You Earn (PAYE): Relevant for employers.

- All holders of a KRA PIN are required to file their returns annually before June of the following year.

- The PIN remains valid indefinitely; however, a person has the option to request deactivation if needed.

-

KRA Support Services : Office Locations & Contacts

Kenya Revenue Authority- Head Office

Times Tower, 19th Floor, Haile Selassie Avenue

P.O. Box 30742, Nairobi, Kenya.

Tel. 310900, 2813068 , 2813160 , 2812011.

Email: callcentre@kra.go.ke

Website: Kenya Revenue Authority website

KRA Desk - Huduma Center Huduma Center Locations -

Useful Links

Was this information helpful ?