Export and Investment Promotion Levy

This comprehensive guide aims to provide a detailed understanding of the Export and Investment Promotion Levy, covering its purpose, implementation, and impact on businesses operating in Kenya. Additionally, the guide will explore the regulatory framework surrounding the levy and its implications for both local and foreign businesses looking to expand their operations in Kenya.

1. What is Export and Investment Promotion Levy (EIPL) in Kenya ?

The Export and Investment Promotion Levy in Kenya is a significant aspect introduced by The Finance Act, 2023. This levy is imposed on specific goods imported into Kenya for domestic use.

The government introduced the Export and Investment Promotion Levy to protect local industries from certain imported goods that can be produced locally. Additionally, the levy aims to provide financing for Micro, Small, and Medium Enterprises (MSMEs) in the manufacturing sector.

2. The Purpose and Benefits of the Export and Investment Promotion Levy

The purpose of the levy is to generate funds that can be utilized to:-

- Support manufacturing growth in the Micro, Small, and Medium Enterprises (MSMEs)

- Enhance export activities.

- Facilitate job creation.

- Reduce dependency on foreign goods and services.

- Encourage investments in the economy.

It serves as a financial mechanism to drive these important economic objectives forward.

3. The Export and Investment Promotion Levy (EIPL) Rates

The export and investment promotion levy is charged at rates of 10% and 17.5% of the customs value of certain specified imported products.

The levy is charged at the rates provided below, and it is the responsibility of the importer to pay this levy when bringing the specified goods into the country for domestic use.

|

Tariff No. |

Tariff Description |

Levy Rate |

|

2523.10.00 |

Cement Clinkers |

17.5 % of the customs value |

|

7207.11.00 |

Semi-finished products of iron or non-alloy steel containing, by weight, <0.25% of carbon; of rectangular (including square) cross-section, the width measuring less than twice the thickness |

17.5 % of the customs value |

|

7213.91.10 |

Bars and rods of iron or non-alloy steel, hot- rolled, in irregularly wound coils of circular cross-section measuring less than 14mm in diameter of cross section measuring less than 8 mm |

17.5 % of the customs value |

|

7213.91.90 |

Bars and rods of iron or non-alloy steel, hot- |

17.5 % of the customs |

|

4804.11.00 |

Uncoated kraft paper and paperboard, in rolls or sheets; Kraft liner; Unbleached |

10% of the customs |

|

4804.21.00 |

Sack kraft paper; Unbleached |

10% of the customs |

|

4804.31.00 |

Other kraft paper and paperboard weighing |

10% of the customs |

|

4819.30.00 |

Sacks and bags, having a base of a width of 40 cm or more |

10% of the customs |

|

4819.40.00 |

Other sacks and bags, including cones |

10% of the customs |

|

|

|

|

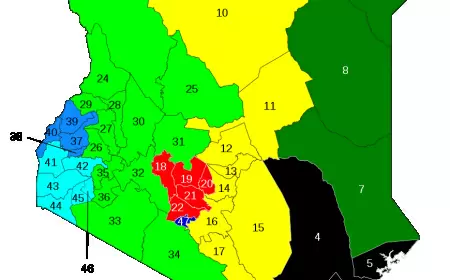

4. Countries Exempt from the Export and Investment Promotion Levy (EIPL)

The export and investment promotion levy is not charged on goods originating from East African Community Partner States that meet the East African Community Rules of Origin.

Was this information helpful ?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

1

Angry

1

Sad

0

Sad

0

Wow

0

Wow

0