Digital Asset Tax

A comprehensive guide to understanding digital asset tax (DAT) in Kenya is essential for individuals and businesses operating in the digital currency transactions space. This guide aims to provide detailed insights into the taxation regulations and requirements that govern the use and exchange of digital assets within the Kenyan jurisdiction.

1. What is Digital Asset Tax (DAT) and Why Was it Introduced in Kenya?

Digital Asset Tax in Kenya refers to the taxation of anything of value that is intangible including cryptocurrency, Non-fungible tokens (NFTs) and digital currencies.

The taxation of digital assets was introduced in Kenya due to the rapidly evolving nature of technology and innovation in the digital space.

2. The Current Tax Laws Governing Digital Asset in Kenya

The Finance Act of 2023 in Kenya governs the taxes on income generated from the transfer or exchange of digital assets. This measure aims to ensure compliance with tax regulations and regulate the taxation of transactions involving digital assets within the country.

3. Who Is Liable To Pay Digital Asset Tax (DAT) ?

- The owner of a platform,digital marketplace or the person who facilitates the exchange or transfer of digital assets.

- A non-resident individual who owns a platform for the exchange or transfer of digital assets.

4. What Digital Asset are Taxable in Kenya?

There are various types of digital assets that fall under this tax regime, including cryptocurrencies like Bitcoin, as well as other forms of virtual currencies and tokens.

The Finance Act of 2023 defines a digital asset in Kenya as

- Anything of value that is not tangible and cryptocurrencies, token code, number held in digital form and generated through cryptographic means.

- A digital representation of value exchanged with or without consideration that can be transferred, stored or exchanged electronically.

- A non-fungible token (NFTs) or any other token of similar nature.

- Income derived from the transfer or exchange of a digital asset i.e the gross fair market value consideration received or receivable at the time of the exchange or transfer of the digital asset.

5. How is Digital Asset Tax Calculated and What are the Rates in Kenya?

Income derived from the transfer or exchange of a digital asset, such as cryptocurrency transactions, is subject to a 3% tax on the gross fair market value consideration received or receivable at the point of exchange or transfer.

6. Submission of Digital Asset Tax Returns

The individual must file the digital asset tax within 5 days of making the transaction and remit the deducted amount to the Kenya Revenue Authority (KRA). Additionally, they should submit a return detailing the payment amount and the tax deducted.

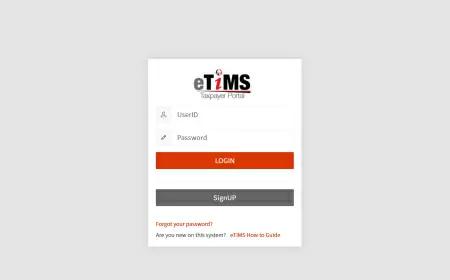

7. How to Register for Digital Asset Tax (DAT) in Kenya

Registration for Digital Asset Tax (DAT) can only be completed online through the Kenya Revenue Authority (KRA) iTax portal. After registering for DAT on iTax, taxpayers can then make payments and file DAT returns. Upon successful registration, the Kenya Revenue Authority (KRA) will issue the applicant a Personal Identification Number (PIN) for the purpose of filing returns and making payments for DAT.

8. Penalty, Interests and Late Submission of DAT Returns

- Failure to submit DAT return by the due date is charged 5% of the tax due.

- Failure to pay DAT by the due date attracts a penalty of 5% of the unpaid tax.

- Interest is charged at 1% per month or any part thereof on any unpaid tax.

9. Conclusion

In conclusion, understanding and complying with Digital Asset Tax regulations is essential for businesses and individuals operating in the digital economy in Kenya. It is important to stay informed about changes in taxation laws related to digital assets to avoid potential penalties or legal consequences.

Was this information helpful ?