Affordable Housing Levy

Discover the Affordable Housing Levy in Kenya and gain a clear understanding of its purpose, impact, and benefits. This comprehensive guide explores how the levy works, its significance in promoting affordable housing, and the positive outcomes it can bring to individuals and communities. Stay informed about this important initiative that aims to address housing challenges in Kenya.

1. What is the Affordable Housing Levy in Kenya?

The Affordable Housing Levy in Kenya is a government initiative aimed at funding the construction of affordable housing units. It is a mandatory contribution made by employees and employers, where 1.5% of an employee's gross salary is deducted and matched by the employer.

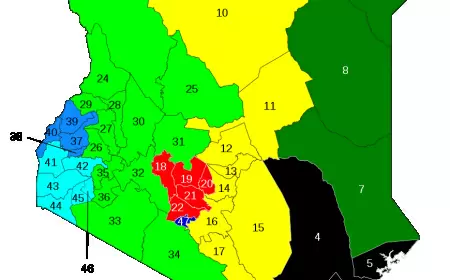

The funds collected are then allocated towards the development of affordable housing projects across the country. The goal of this levy is to address the housing shortage and provide affordable housing options to Kenyan citizens.

2. Why was the Affordable Housing Levy Introduced?

The Affordable Housing Levy was introduced as a government policy to address the growing issue of housing affordability. With rising property prices, growing population and limited affordable housing options, many individuals and families were struggling to find suitable and affordable homes.

The purpose of the Affordable Housing Levy is to generate funds that can be used to support the development of affordable housing projects. Through this levy, the government aims to ensure that a certain percentage of new residential developments are dedicated to providing affordable housing options for low-income individuals and families.

By introducing this levy, the kenyan governments aim to:-

- Create a more inclusive and equitable housing market.

- Promote social cohesion by ensuring that people from different income brackets have access to safe and decent homes.

- Assist in alleviating some of the pressures on social housing waiting lists by increasing the availability of affordable rental and homeownership opportunities.

Overall, the introduction of the Affordable Housing Levy is a proactive step towards addressing the challenges associated with housing affordability. It demonstrates a commitment from the government to prioritize accessible and affordable housing options for their citizens.

3. How is The Affordable Housing Levy Calculated in Kenya?

Levy Collection Process

The Kenya Revenue Authority is the appointed collecting agent of the Affordable Housing Levy (AHL) in Kenya.

All employers are required to declare the Affordable Housing Levy (AHL) under the PAYE return on iTax. They should generate a payment slip under the tax head "agency revenue" and tax sub-head "Housing Levy" and make payments at KRA agent banks or through mobile money.

Contribution Rates

The calculation of the affordable housing levy is based on an employee's gross salary. According to the regulations, both employers and employees are required to contribute 1.5% of the employee's monthly gross salary towards the National Housing Development Fund (NHDF).

This means that if an employee earns a gross salary of Ksh 50,000 per month, they would contribute Ksh 750 towards the fund, with their employer matching this contribution.

4. The Impact of the Affordable Housing Levy on Citizens and Economy

The implementation of the Affordable Housing Levy in Kenya has significant impacts on both citizens and the economy. Some of the key impacts include:

- Affordable housing opportunities for low-income earners:This levy aims to provide affordable housing opportunities for low-income earners, addressing the pressing issue of housing affordability in the country.

- Job creation in construction sector : One key impact of this levy is the creation of job opportunities in the construction sector. As more affordable housing projects are initiated, there is a growing demand for skilled and unskilled labor, leading to increased employment rates. This not only improves the livelihoods of individuals but also contributes to overall economic growth.

- Economic Growth : The Affordable Housing Levy has a positive effect on the economy by stimulating various sectors. The construction industry experiences a boost as more projects are undertaken, leading to increased demand for construction materials and services. This, in turn, benefits related industries such as manufacturing and transportation.

With improved access to affordable housing options, citizens have more disposable income that can be allocated towards other sectors of the economy. Increased spending power can stimulate consumer demand and drive economic growth through various sectors like retail, hospitality, and services.

5. Key Points to Understand about Affordable Housing Levy

- The Affordable Housing Levy is a mandatory contribution that all employees must pay monthly. It is calculated at a rate of 1.5% of the employee's gross monthly salary. The employer is also required to match this contribution at the same rate, with no maximum limit.

- The levy is to be computed on the gross pay, which includes both cash and non-cash benefits advanced to the employee.

- The Housing Levy cannot be reduced by the Affordable Housing Relief. However, payments for houses purchased under the Affordable Housing Scheme will be eligible for relief against income tax.

- The levy is collected by the Kenya Revenue Authority (KRA) and declared in the monthly Pay As You Earn (PAYE) return. It is then paid together with PAYE.

- The levy is due by the 9th day of the month following the month of deduction.

- An employer who fails to comply with the provisions of the Affordable Housing Levy is liable to pay a penalty of 2% of the unpaid amount for each month that it remains unpaid.

6. Useful Links

Was this information helpful ?